What Is Leveraged Buyout Or LBO A Career Guide In 2025 - Leveraged buyouts and their history. Up to 10% cash back understand the foundational structures and strategies of private equity funds. The operating structure of a leveraged buyout/private equity firm. Learn leveraged buyouts (lbos) with cfi's newest course. Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a corporate acquirer. You should also read this: Golf Courses In North Myrtle Beach

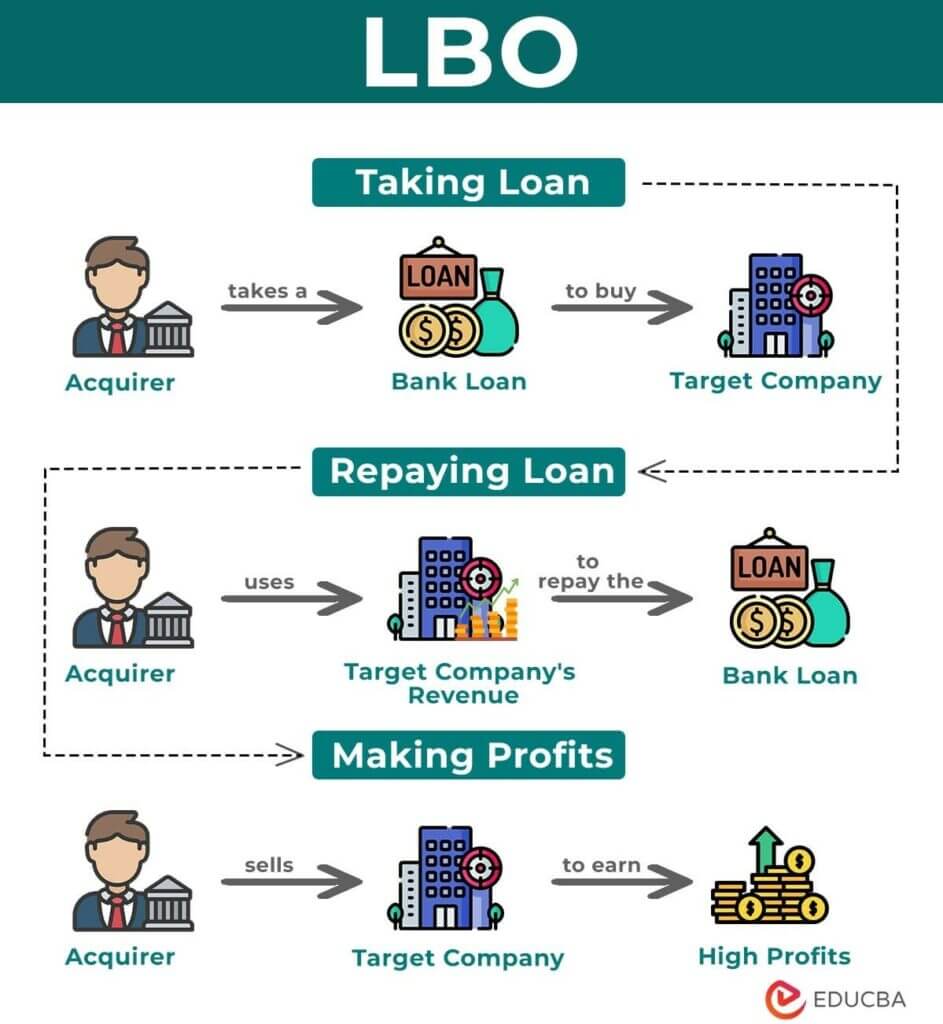

Leveraged Buyout (LBO) Modeling Course at CFI CFI - Leveraged buyout (lbo) is the purchase of all or substantially all of a company using large amount of debt. The operating structure of a leveraged buyout/private equity firm. Prepare a leveraged buyout (lbo) analysis. Build a simple lbo model and forecast income statements. Leveraged buyouts and their history. You should also read this: Golf Course In Hobbs Nm

What is a Leveraged Buyout? - Learn leveraged buyouts (lbos) with cfi's newest course. Up to 10% cash back understand the foundational structures and strategies of private equity funds. Case study of a successful leveraged buyout: The largest leveraged buyouts in history. Leveraged buyout (lbo) modeling is used widely by investment banks and private equity firms and is often part of a finance interview. You should also read this: Augusta 70.3 Bike Course

The Ultimate Guide to Leveraged Buyouts (LBOs) + Examples - Leveraged buyout (lbo) modeling is used widely by investment banks and private equity firms and is often part of a finance interview. Topics covered in this course include: Define leveraged buyouts and their significance in corporate finance. Review an lbo transaction and financing structure; Since the 1960s, lbo has been the primary investment strategy of private. You should also read this: Course Registration Schedule Rutgers

Leveraged Buyout Model - Topics covered in this course include: Learn leveraged buyouts (lbos) with cfi's newest course. The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Learn to build an lbo model from scratch in cfi's leveraged buyout modeling course. Up to 10% cash back understand the foundational structures and strategies of private equity funds. You should also read this: Piney Apple Golf Course Slatersville Road Biglerville Pa

Leveraged Buyout (LBO) Modeling Course at CFI CFI - Leveraged buyout (lbo) is the purchase of all or substantially all of a company using large amount of debt. Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a corporate acquirer. Leveraged buyout (lbo) modeling is used widely by investment banks and private equity firms and is often part of a finance interview. Understand. You should also read this: Gilroy Golf Course Tee Times

Leveraged Buyout (LBO) Modeling Course at CFI CFI - Those with a basic understanding of free cash. Review an lbo transaction and financing structure; The operating structure of a leveraged buyout/private equity firm. Leveraged buyout (lbo) is the purchase of all or substantially all of a company using large amount of debt. The largest leveraged buyouts in history. You should also read this: Hunters Safety Course Mississippi Online

What is Leveraged Buyout(LBO)? Types, How it Works & Examples - Learn to build an lbo model from scratch in cfi's leveraged buyout modeling course. Explore sources & uses schedules and calculate equity returns. The operating structure of a leveraged buyout/private equity firm. Since the 1960s, lbo has been the primary investment strategy of private. Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a. You should also read this: Geneva Farm Golf Course Md

Complete Leveraged Buyout (LBO) Course - Understand market reaction to transactions; A completed guide to leveraged buyout modeling & technical interview preparation Understand tax implications of various tax structures for both the buyer and. Review an lbo transaction and financing structure; It starts off by explaining the meaning of an lbo with the. You should also read this: Public Golf Courses In Martha's Vineyard

Leveraged Buyout Modeling Online Deal Making Course - Understand market reaction to transactions; The course provides a comprehensive understanding of private equity investment funds and leveraged buyout (lbo) transactions. Topics covered in this course include: Leveraged buyouts and their history. Analyze whether an m&a transaction is accretive or dilutive to the earnings per share of a corporate acquirer. You should also read this: Golf Courses In Anthem Az