IRS Approved Continuing Education AFSP - Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Explore the afsp tax credential, its benefits, eligibility, and how it compares to other tax qualifications. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Want to become an irs afsp record of completion holder?. You should also read this: Can You Take Lpn Courses Online

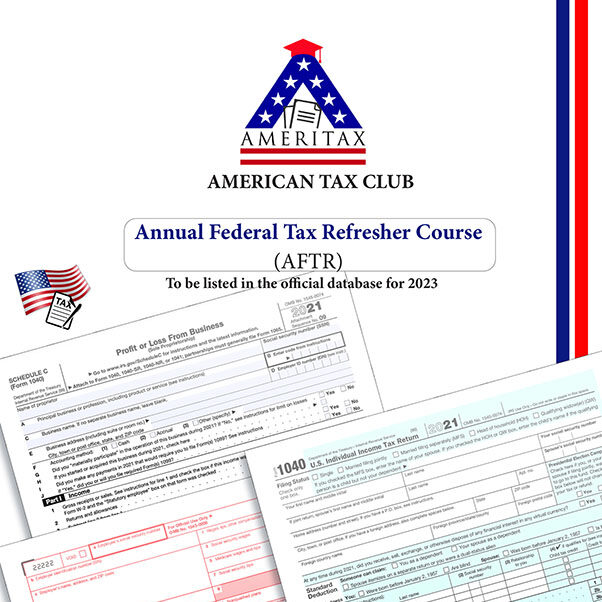

IRS AFSP(Tax Courses) - The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. Explore the afsp tax. You should also read this: Best Thai Golf Courses

AFSP IRS Approved Continuing Education AFSP - The annual filing season program. Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Earn your afsp record of completion with irs approved continuing education. What is the annual filing season program? Enhance your tax expertise today. You should also read this: Abac Golf Course

IRS Annual Federal Tax Refresher Course AFTR Training - Want to become an irs afsp record of completion holder? What is the annual filing season program? Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. The annual filing. You should also read this: Security Officer Courses

Annual Federal Tax Refresher Course (AFTRC) + Classes 2024 Ameritax - Click here to learn more about how you can be part of the irs annual filing season program (afsp). Explore the afsp tax credential, its benefits, eligibility, and how it compares to other tax qualifications. If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual. You should also read this: Columbia Bridges Golf Course Illinois

5 reasons to earn the AFSP Record of Completion Surgent CPE - Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. 2025 tax brackets, thresholds, and inflation adjustments. The irs afsp continuing education program is intended to recognize and encourage unenrolled tax return preparers who want to voluntarily increase their tax knowledge and improve their tax. The annual filing season program. Irs. You should also read this: Mexico Golf Courses

IRS AFSP Program Exam + Classes Ameritax Online - What is the annual filing season program? Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. Want to become an irs afsp record of completion holder? Click here to learn more about how you can be part of the irs annual filing season program. You should also read this: Augusta National Course Map Print

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]](https://ipassthecpaexam.com/wp-content/uploads/2020/08/ipassthecpaexam.com1_.png)

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] - To recognize ptin holders who pursue greater professionalism, the irs established the annual filing season program (afsp). If you’re a tax preparer looking to participate in the irs annual filing season program (afsp), one of the key requirements is completing the annual federal tax refresher. Explore the afsp tax credential, its benefits, eligibility, and how it compares to other tax. You should also read this: Colorado Dmv Approved Defensive Driving Course

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting](https://i.pinimg.com/originals/51/81/47/518147979ce7331e5a805205a2fb38f8.png)

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021] Accounting - Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Want to become an irs afsp record of completion holder? Find tax classes at tax practitioner institutes in your state and receive continuing education credits at a reasonable cost. Irs afsp (annual filing season program) tax courses are a series of continuing education courses offered. You should also read this: Online Contractor Course

Programa de Certificación IRS/AFSP Centro Latino de Capacitacion - The irs annual filing season program is a voluntary program designed to highlight tax preparers who have demonstrated a willingness to improve their tax knowledge and filing competency. Our irs approved tax class is for tax preparers who want to take an irs afsp tax preparation course to complete their continuing education requirements. To recognize ptin holders who pursue greater. You should also read this: Oso Golf Course